In Time poster. Copyright of 20th Century Fox

I watched In Time a couple of days ago and while I’ve been a huge fan of all four of Andrew Niccol’s big name movies (In ranking order: Gattaca, S1m0n3, Lord of War, Truman Show), I must admit that In Time let me down quite a bit, but also strangely I loved the rather nicely realized version of an economic model. The movie was fine – Cillian Murphy’s acting was top notch, but the same cannot be said about Justin Timberlake. I loved the premise of the story, I loved the setting of the story, and I am fine with the story being all over the place. They kept hinting at more (I personally was hoping for a Logan’s Run-esque payoff – i.e. something larger than themselves), but there was no satisfying payoff in the end, and I was fine with that. I give In Time a 6.5/10. The following will be an exploration of the economics in In Time. Needless to say, here is a spoiler alert

What really bugged me though, was the mechanics of the currency. The premise of the movie is as such: time is now a currency, and intrinsically linked to their lives, and the lower class of society has to fight for their lives. They live from day to day, working just enough to earn them one more day of living. Another premise is that at least nominal price inflation happens. At the beginning of the movie, we the audience are told, and shown with rather emotional consequences that the prices of things are rising. A third premise that I think is fairly important in considering the economics of In Time is that the currency is spent every living second of a person’s life. Let us not consider to whom first, and assume that the currency evaporates. It is on these premises the plot of the movie was built upon. Essentially what bugged me the most was this: Given the premises of the movie, why was there even inflation to begin with? I try to give reasons in this article.

Ch17. The Essential Properties of Interest and Money

But first a detour to roughly determine the environment that the characters were in. Let me bring you to Keynes’ General Theory of Employment, Interest and Money. Here is a very terribly abridged TL;DR:

- There is a rate of interest in terms of itself for every commodity (yes, this self-referential fuckery haunted me for years in Uni, but really it’s just algebra)

- Some assets produce an output, or yield, measured in itself

- A yield curve can be built.

This is a place where time is loanable. With interest of course. What then, is the short term interest rate like? Probably high. But think about it – in the movie, inflation of prices is shown and in fact, beaten into the heads of audiences rather bluntly. Assuming they’ve got a Central Bank in the system, which sets and govern interest rates, that would mean longer-term interest rate is probably low (to negative). And so, to quote cfgt, “they yield curve is very very fucked up”.

So, let’s try jumping into the world. Say you earn 26 hours daily (Let’s use ₮H26 to denote time as a currency as opposed to the passage of time). Now, your minimum consumption is ₮H24, because a day has 24 hours. If you are earning minimum wage, it is quite inevitable then at some point in time (har har, see the pun?), when you need to make a loan. Short term loans would carry a high interest rate, simply because the demand for currency(time) is not elastic. If you don’t have time, you die.

I tried figuring out why the longer term rates would be low (and by all deductions it HAS to be a low or negative long term rate), and turns out Tyler Cowen had figured it out. As he said:

Medium-term rates, however, are negative in real terms. Carry around too much time and it will be stolen and you die. The economy has a strongly inverted yield curve and that discourages traditional financial intermediation and investment. Wealth continues to fall, which exacerbates security problems, in turning lowering the negative medium-term real rates even further. A downward spiral ensues.

So we’ve got a rough idea of things. I shall leave the actual macroeconomic modelling to better experts (afterall, I’m only very good at microeconomics, not macro).

Hyperinflation

The thing that bugged me the most about the movie is the depiction of hyperinflation and the horribad implications of it. Generally inflation is linked with how much money is in circulation in the economy at that given periods of time. The idea is, if there are more money circulating in the system (i.e. people are spending them), the higher prices of goods will be. Hyperinflation is depicted in the movie. Comparing Day One and Day Two, hyperinflation as depicted in the movie means that there is more money in circulation in Day Two than in Day One. Think about it. Because I did throughout the movie and I came to a very unsettling conclusion.

How do you increase the supply of money in the system? You can “create” them out of nowhere like modern day money* beware: this is actually VERY VERY VERY SIMPLIFIED macroeconomics. Creating money is a valid thing to do in my opinion . But this idea is shot down immediately by the premise: When everyone is born, they have 1 year ‘s worth of currency (time), which will only be activated when they hit 25. To create more money, it means: a) more sex and procreation; b) more deaths after spending. The minimum daily consumption of 24 hours is evaporated from the system – it leaves the system never to be found again. Assuming everyone needs to eat, and the average daily consumption is ₮H30 (₮H24 + ₮H6), that means the ₮H8760* 1 year of 365 days has 8760 hours everyone has when they hit 25 years of age will only last them 292 days. If they do not work, and die after 292 days, that means they would have contributed ₮H2190 to the system each within their short lifetimes.

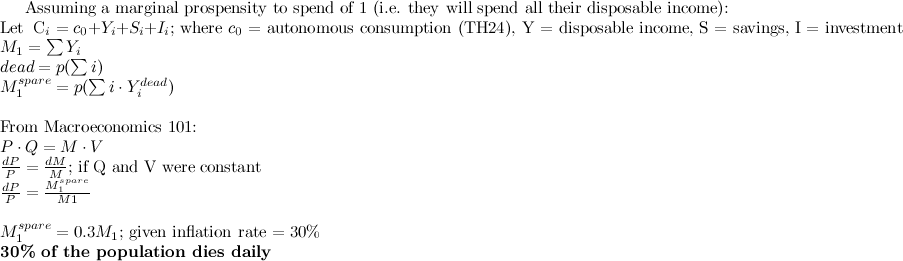

And now for some simple algebra fun * just because I have a nice LaTeX plugin for WordPress and it would seem a shame not to use it – though this final LaTeX rendering was not due to the plugin. . If you want to, you can skip the math.

Okay, so maybe I exaggerated. It’s not 30% of the population dying. 30% of M1 being inflated into the system, depending on situation could mean either a very rich person spent 30% of the world’s supply of money every day, or many many people die to provide a 30% daily inflation rate. We know from the movie that the rich, while they spend money, save more money than spend it. This section will be redone. I spent way too many hours on the LaTeX plugin, but the gist is this: hyperinflation means people died to inflate the system.

Implications

Hyperinflation then means this: everyday, more and more people are dying left and right. Every death contributes to the hyperinflation. Given the hyperinflation, it also must imply that the death rate is higher than the birth rate, implying a negative growth rate of humans. I had figured out something like that shortly after Will Salas bought coffee. My instincts were later validated by Henry Hamilton’s phrase “for the few to be immortal, many must die”, although I would be quite confused over the statement the more I thought about the economy as time went on. I later surmised that the rich also have to had saved a lot more when the system began.

Part of my confusion was that a negative growth rate was not a bad thing. It’s simply the market correcting itself over a longer period of time. In fact that was what I thought when Will’s mum tried to board the bus. I had thought to myself: “aha, 2 hours walk costs equals ₮H2 worth of bus ride, equal opportunity cost. The market is catching up to this information”. Of course then she died a few seconds short of having a proportion of a century’s worth of time.

Another part that caused me confusion in thoughts is that Will Salas got a pay cut because he didn’t fulfill the increased quota. It was implied in the movie that the quota kept increasing, and wages kept dropping. For a moment I kept wondering how the hyperinflation could happen given the average wages kept going down. You see, an increase in average wages will also inflate a system, while a decrease in average wages will generally stagnate a system. After a bit of discussion with cfgt, I’ve come to the conclusion that the scene was not representative of average wages, merely a depiction of events in a hyperinflated world.

Considering hyperinflation, what do our protagonists do? In a very misguided attempt to redistribute wealth, our protagonists very cleverly robbed time banks to give the money away, which in all probability (and even being depicted) will be instantly spent instead of saved – meaning more money in the system, meaning more inflation of prices. During the scene where Will and Sylvia were hiding in a roof looking at prices of bread go up to 4 Months, while complaining that what they’re doing isn’t helping much, I nearly shouted “YOU DICKS! YOU JUST INFLATED A VERY VOLATILE SYSTEM!!!!!! DIIIICKS!” at the screen.

The movie went downhill for me from that scene on. I was hoping they would have learnt their lesson in basic Macroeconomics 101, but what do they do? Redistribute 1 Million Years to the general populace. I put on my WTF face and continued.

They…

Another thing that bugged me was the constant use of “they”. The use of “they” is in the context of “they keep raising the prices”, implying an authority that controls the prices. Assuming that the story is set in a capitalistic world (and indeed it would be easy to observe evidence that point that way), there should be no “they”. “They” would simply be the invisible hand of the market. In short, our protagonists were railing against an invisible enemy, a plural phantom made up of the sum of activities of everyone.

That to me is plainly futile activity. I understand that the point of the movie is to rail on Corporate Greed, but it had so far failed to show evidence of said Corporate Greed. It doesn’t even show a regressive wealth distribution system in which the rich take from the poor. Instead, it felt like a rant about how bad it is to be poor, and it’s the ethical thing to do to blame Corporate Greed. Don’t get me wrong – I don’t even have a bed to sleep on lest you think I am the 1% – but ranting against the rich because they are rich is just plain stupid and unproductive, and that exactly was how the movie felt like.

Anyway, tell me what you think? I guess the next movie for me would be Margin Call.

Side note: I’ll redo the LaTeX and math part. I had wanted to write a fair bit more but I ended up wasting 3 hours fiddling with MathJax and it keeps telling me that it won’t parse.